tucson sales tax calculator

Spring Valley AZ Sales Tax Rate. Cochise County 61 percent.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

. The minimum combined 2022 sales tax rate for Tucson Arizona is. The current total local sales tax rate in Tucson AZ is 8700. The average sales tax rate in Arizona is 7695.

Stanfield AZ Sales Tax Rate. Integrate Vertex seamlessly to the systems you already use. How to Calculate Sales Tax.

Wayfair Inc affect Arizona. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Multiply the vehicle price after trade-in andor incentives by the sales tax fee. Tucson Sales Tax Rates for 2022. The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson.

The minimum is 56. These rates were entered mostly from tables published by the ADOR that were effective as of August 1 2015. Free sales tax calculator tool to estimate total amounts.

Groceries are exempt from the Tucson and Arizona state sales taxes. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Find list price and tax percentage.

The Arizona sales tax rate is currently. Springerville AZ Sales Tax Rate. 111 sales tax in Pima County.

This is an Arizona sales tax calculator designed to meet the specific needs of the construction industry. The South Tucson Sales Tax is collected by the merchant on all qualifying sales made within South Tucson. Maricopa County 63 percent.

Multiply the price of your item or service by the tax rate. With local taxes the total sales tax rate is between 5600 and 11200. As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No.

The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax Comparison Calculator for 202223. When combined with the state rate each county holds the following total sales tax. Tucson is located within Pima County ArizonaWithin Tucson there are around 52 zip codes with the most populous zip code being 85705As far as sales tax goes the zip code with the highest sales tax is 85725 and the zip code with the.

For more information on vehicle use tax andor how to use the calculator click on the links below. Method to calculate South Tucson sales tax in 2021. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. What is the sales tax rate in South Tucson Arizona. Pinal County 72 percent.

In unincorporated Pima County where the sales tax is 61 percent that would only be 9150. Sales tax in Tucson Arizona is currently 86. Did South Dakota v.

This is the total of state county and city sales tax rates. Price of Accessories Additions Trade-In Value. Would you drive an extra mile or two for.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The minimum combined 2022 sales tax rate for South Tucson Arizona is. United States Tax ID Number Business License Online Application.

How to Calculate Arizona Sales Tax on a Car. The County sales tax rate is. Arizona has recent rate changes Wed Jan 01 2020.

Did South Dakota v. Then use this number in the multiplication process. Gila County 66 percent.

City and County Additions. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Divide tax percentage by 100 to get tax rate as a decimal.

If this rate has been updated locally please contact us and we will update the sales tax rate for Tucson Arizona. The average cumulative sales tax rate in Tucson Arizona is 801. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 450 city sales tax. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. The average sales tax rate in Arizona is 7695.

The December 2020 total local sales tax rate was also 8700. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. The South Tucson sales tax rate is.

Method to calculate Old Tucson sales tax in 2021. Ad Find Tucson Sales Tax. Groceries are exempt from the South Tucson and.

Select the Arizona city from the list of cities starting with T below to see its current sales tax rate. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Tax rates can be. 21120 for a 20000 purchase. This is the total of state county and city sales tax rates.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. This includes the rates on the state county city and special levels. The sales tax jurisdiction name is Arizona which may refer to a local government division.

As of 2020 the current county sales tax rates range from 025 to 2. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. The default sales tax rates are provided for your convienience.

You can print a. The Arizona sales tax rate is currently. Apache County 61 percent.

The 2018 United States Supreme Court decision in South Dakota v. Az Sales Tax - Prime Contracting - Class 015. For example imagine you are purchasing a vehicle for 45000 with the state sales tax of 56.

The County sales tax rate is. You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code. Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use.

Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement. The Tucson sales tax rate is. Tax Paid Out of State.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Sales Tax Calculator Sales Tax Table. Arizona AZ Sales Tax Rates by City T The state sales tax rate in Arizona is 5600.

You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. South Tucson AZ Sales Tax Rate.

There is no applicable special tax.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Property Tax Calculator Casaplorer

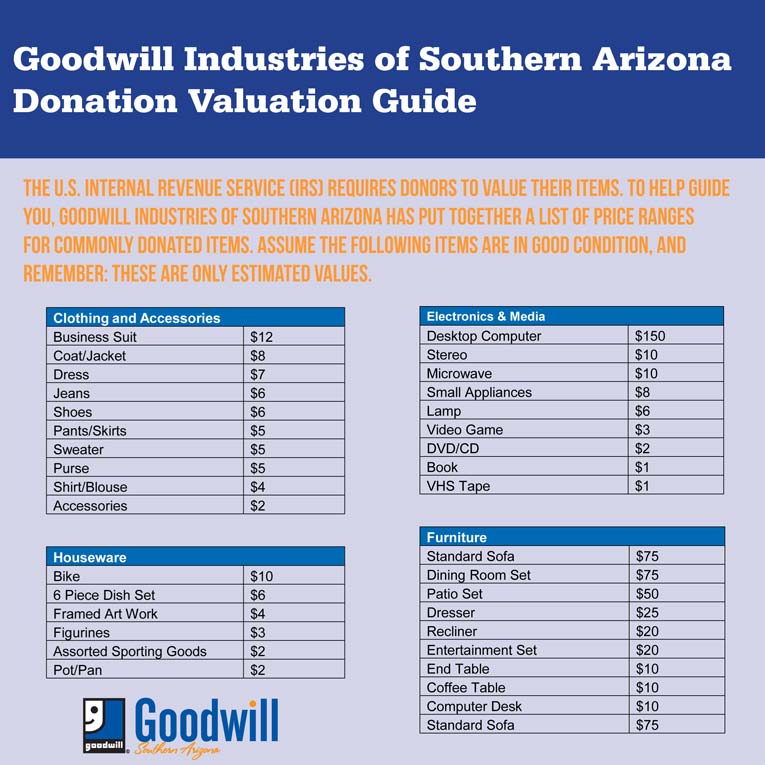

Estimate The Value Of Your Donation Goodwill Industries Of Southern Arizona

Arizona Proposition 208 3 5 Surcharge Tax Phoenix Tucson Az

Do This To Save 16 On Every Marijuana Purchase In Arizona

How To Calculate Cannabis Taxes At Your Dispensary

Property Taxes In Arizona Lexology

Arizona Sales Tax Small Business Guide Truic

Property Tax Calculator Casaplorer

How To Calculate Sales Tax For Your Online Store

A Complete Guide On Car Sales Tax By State Shift

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

2021 Arizona Car Sales Tax Calculator Valley Chevy

How To Charge Sales Tax Vat With Samcart Samcart

Arizona Income Tax Calculator Smartasset

Arizona Sales Tax Small Business Guide Truic

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 7 Free To Download And Print Tax Printables Sales Tax Tax